FTC Report

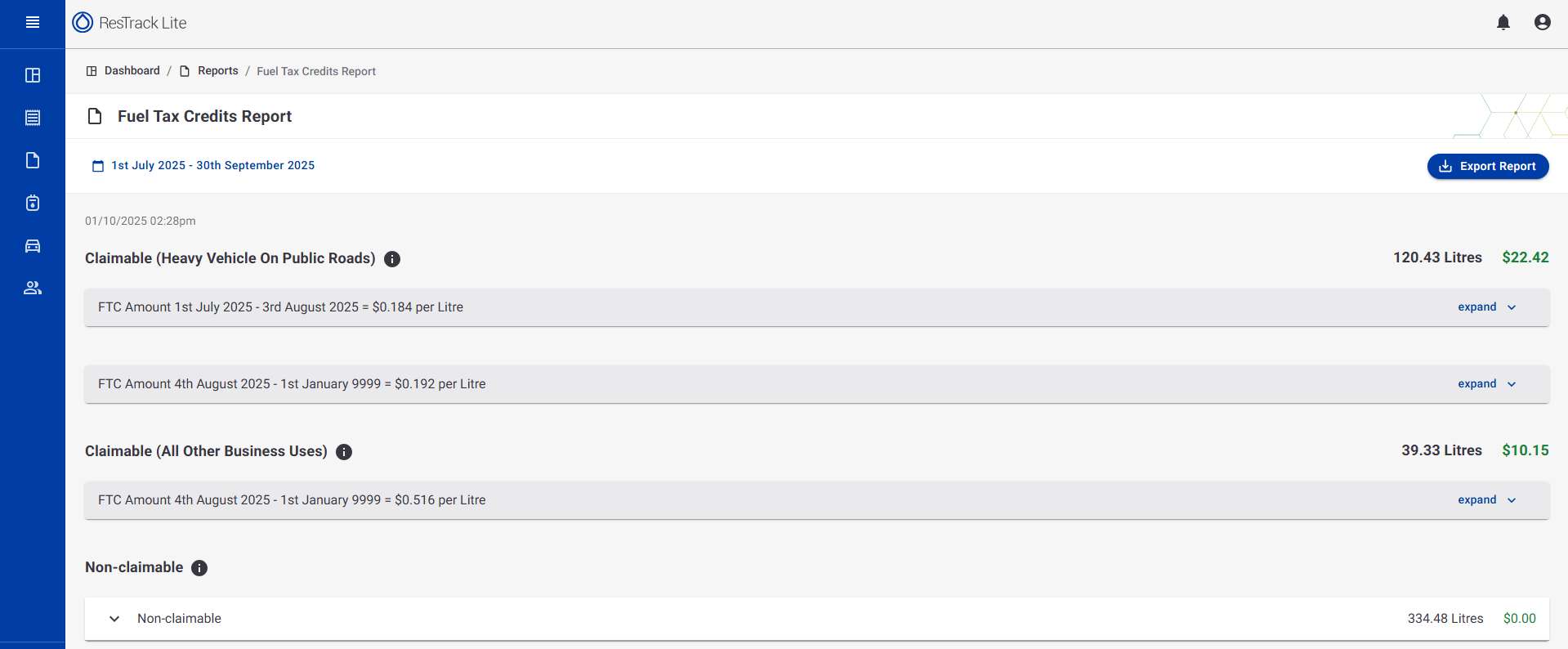

The Fuel Tax Credits (FTC) Report helps customers calculate and claim fuel tax credits for eligible fuel usage. This report summarises your fuel usage and shows which portions are claimable, partially claimable, or non-claimable.

Date Range

At the top of the report, you will see the selected date range for the report.

- Example: 1st July 2025 – 30th September 2025

- The report only includes fuel transactions within this period.

Sections of the Report

The report is divided into three main sections:

1. Claimable (Heavy Vehicle On Public Roads)

- Displays fuel used in heavy vehicles operating on public roads that is eligible for FTC.

- Each row shows:

- FTC Amount for the date range (e.g.,

$0.184 per Litre) - Total litres and total claimable dollar amount.

- FTC Amount for the date range (e.g.,

- Use the expand link to see detailed transactions.

2. Claimable (All Other Business Uses)

- Displays fuel used for other business purposes that are eligible for FTC.

- Each row includes the FTC amount per litre and the total claimable amount.

- Click expand to view detailed usage.

3. Non-claimable

- Displays fuel transactions that are not eligible for FTC.

- Shows total litres and $0.00 claimable amount.

- You can expand this section to review non-claimable transactions.

Exporting the Report

- Click the Export Report button in the top-right corner to download the report in your preferred format.

- Exported reports can be used for auditing or submission purposes.

Tips

- Ensure your fuel entries are correctly categorised to maximise claimable credits.

- Check date ranges before exporting to avoid missing any transactions.